Business Loan Calculator

Use our SME Business Loan Calculator below to find out how much you can borrow to take your business to the next level.

Want to understand the cost of your loan?

Use our business loan calculator below to find out how much you can borrow to take your business to the next level.

Calculations are indicative only and intended as a guide only. The figures calculated are not a statement of the actual repayments that will be charged on any actual loan and do not constitute a loan offer.

Monthly payments

-

Monthly interest

-

Total interest

-

Length of loan

-

Total cost of loan

-

About this business loan calculator

Looking to estimate monthly repayments or overall costs for a <a-business-loan>business loan</a-business-loan>? With <a-bbb-href>43% of UK SMEs</a-bbb-href> using external finance to fuel growth, our calculator helps UK businesses – from startups to established companies – gain a clearer picture of potential borrowing costs. <br></br> <br></br> Get accurate estimates in seconds for loan amounts from £1,000 to £20 million, whether you’re seeking a <a-small-business-loan>small business loan</a-small-business-loan>, a <a-commercial>commercial property mortgage</a-commercial>, or <a-asset>asset finance</a-asset> to invest in new equipment. <br></br> <br></br> No obligation, no impact on your credit score – just a clear, reliable calculation to help plan your business funding. Please note that the results are indicative only.

How our business finance calculator works

- Planning to take out a business loan is simple with Funding Options by Tide. Our Business Loan Repayment Calculator gives you an instant estimate so you can budget with confidence and compare your options before committing to a lender.

- Enter the loan amount: Estimate how much you plan to borrow – from £1,000 to £20 million

- Select the interest rate: Our business loan rates calculator allows you to adjust the interest rate assumption to see how it might affect your monthly and total repayments.

- Choose your repayment term: Decide whether you need short-term funding (59% of applicants choose two years or less) or a longer-term solution to spread out the cost.

- Review your repayments: The calculator shows estimated monthly costs, total interest, and overall repayment amounts to help you understand the true cost of borrowing.

You can use our business loan monthly payment calculator to calculate business loan repayments and plan your budget with confidence.

Please note that all results are indicative and may vary depending on the actual terms offered by your chosen lender.

Understanding your business loan calculator results

Your calculator results show three key figures that determine whether a business loan works for your budget: <br></br> <br></br> <li><b>Monthly payments:</b> This is the total amount you’ll need to repay each month, including both the principal (the original loan amount borrowed) and interest.</li> <li><b>Monthly interest:</b> This is the portion of your monthly payment that goes toward interest charges. In the early months of your loan, a larger portion goes to interest, while later payments focus more on reducing the principal balance.</li> <li><b>Total interest:</b> This is the total amount of interest you’ll pay over the duration of the loan. Even a 1-2% difference in interest rates can save you thousands on larger loans!</li> <li><b>Length of loan:</b> This is the total number of months that you’ll repay the loan over. Longer-term lengths should mean lower monthly payments, but they’ll also typically result in higher total interest.</li> <li><b>Total cost of loan:</b> This is the total amount you’ll pay over the duration of the loan, including the initial principal amount and total interest.</li> <br></br> <br></br> Your calculator results can help you answer the question, “How much will my business loan cost?” And it’ll help ensure you’re making a decision based on complete information, not just the headline interest rate. <br></br> <br></br> <b>Tip:</b> Focus on both monthly affordability (can your cash flow handle the payments?) and total cost (is the overall expense justified by your business needs?) A suitable loan should balance both manageable monthly payments and reasonable total costs.

Startup business loan calculator options

Business owners, finance managers, and accountants often use a startup business loan calculator to understand how repayments might fit into their cash flow projections. It’s particularly important for new businesses working with limited revenue and unpredictable income. <br></br> <br></br> Whether you’re launching a tech startup, opening a local retail shop, or expanding your services, getting a clear estimate of borrowing costs early can help you plan effectively. <br></br> <br></br> For limited companies, a limited company loan calculator might factor in extra factors like corporate tax and business structures. <br></br> <br></br> Things for startups to consider: <br></br> <br></br> <li>New businesses often face higher interest rates due to a more limited trading history</li> <li>The government’s <a-start-up-loans>Start Up Loans</a-start-up-loans> scheme offers fixed 6% rates for loans up to £25,000</li> <li>Consider how seasonal revenue might affect your ability to make consistent payments</li> <li>Factor in a cash flow buffer as many startups underestimate their <a-working-capital >working capital</a-working-capital > needs</li> <br></br> <br></br> You can use our small business loan calculator to compare different scenarios, from conservative growth projections to more optimistic expansion plans.

Calculators to compare different business loan options

A variety of different business loan calculators exist to help you compare different types of funding and find the right solution for your needs.

Secured vs. unsecured business loan calculator

<a-secured-business-loans>Secured business loans</a-secured-business-loans> require assets (eg property, vehicles, or equipment) as collateral. This reduces the risk for lenders, usually resulting in lower interest rates and access to larger borrowing amounts. A secured vs. unsecured business loan calculator can help you compare how collateral can reduce your monthly payments. <br></br> <br></br> <a-unsecured-business-loans>Unsecured business loans</a-unsecured-business-loans> don’t need security but generally come with higher interest rates. They’re ideal for businesses that don’t have significant assets or when you don’t want to risk valuable business assets. A secured vs. unsecured business loan calculator can show the premium you might pay for this flexibility.

Asset finance calculator

Need to purchase equipment, vehicles, or machinery without tying up all your working capital? An asset finance calculator lets you estimate monthly repayments based on the cost of the asset and the lease or hire purchase terms. This way, you can plan investments to grow your business while preserving cash flow for daily operations.

Why use a business loan calculator?

- Quick estimates: instantly gauge how much your monthly repayments could be.

- Cash flow planning: budget effectively, especially if you have seasonal revenue.

- Compare rates: see how even a small change in interest rate affects your total repayment.

- Informed decisions: whether it’s a startup loan calculator or asset finance calculator, you can gauge overall affordability before proceeding.

We're here to help

Find the right Funding Options without affecting your credit score by filling out our quick and easy form.

See your Funding OptionsHow does it work?

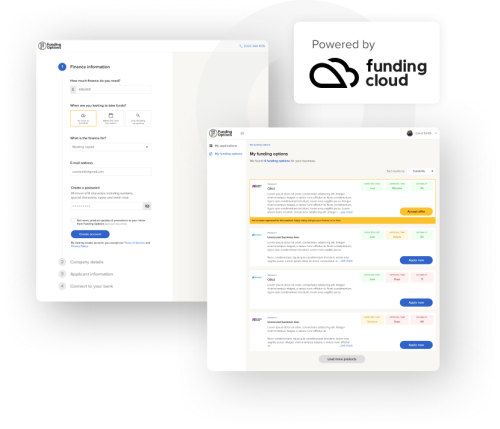

We break down funding barriers with a simple application process that empowers you. Our technology, Funding Cloud, accurately validates your business profile, matching you to the industry’s largest lender network. Funding results are uniquely tailored to each and every business.

Tell us how much you need

Tell us how much you need to borrow, what it's for and provide some basic information about your business.

Get an instant comparison

Our smart technology will compare up to 120+ lenders and match you with the right finance options for your needs.

Apply and get your funding

We'll help you through the process from application to receiving your funds.